Business Plan:

Business Plan Option:

The Hillside Haven: Agri-Living and Condominiums

Feasibility Study Report

Executive Summary

The Hillside Haven project is an unusual dual-purpose complex that combines luxury residences with a sustainable agarwood plantation. This feasibility study looks at the potential of this one-of-a-kind company that combines real estate and agriculture to produce cash.

Project Overview

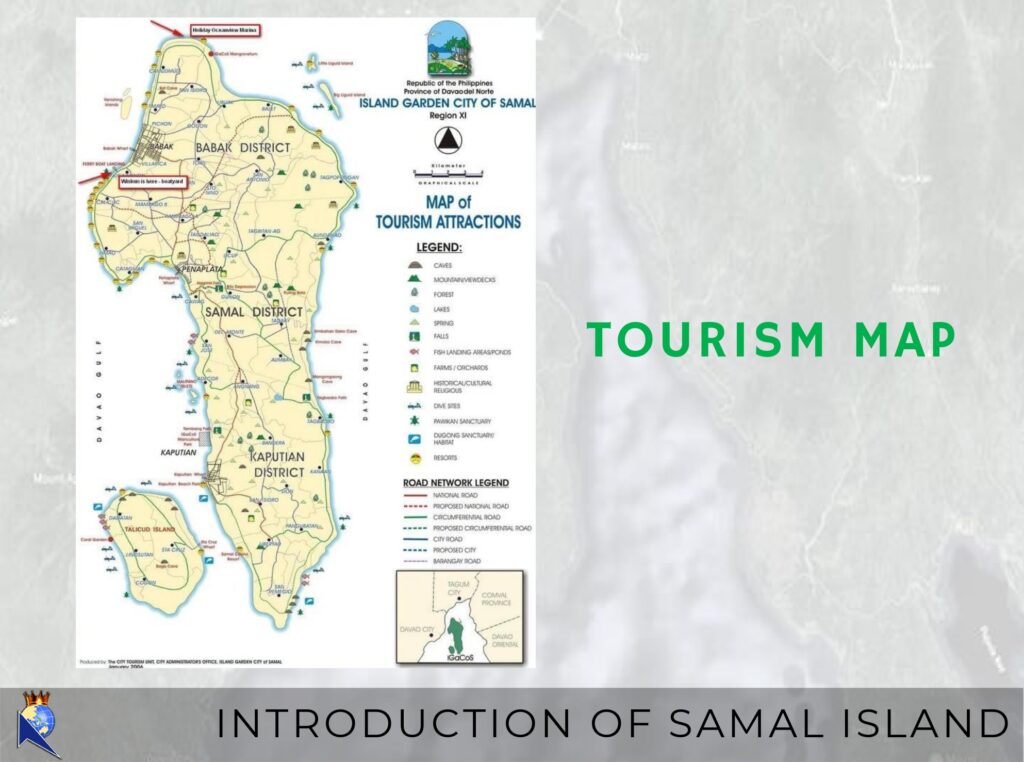

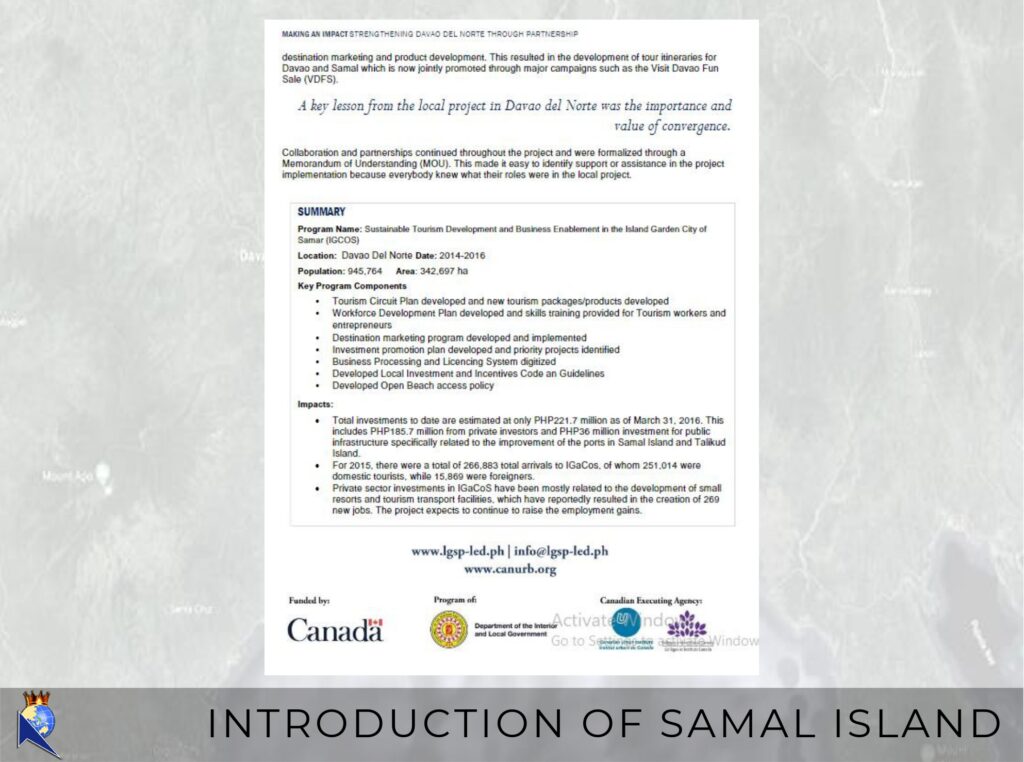

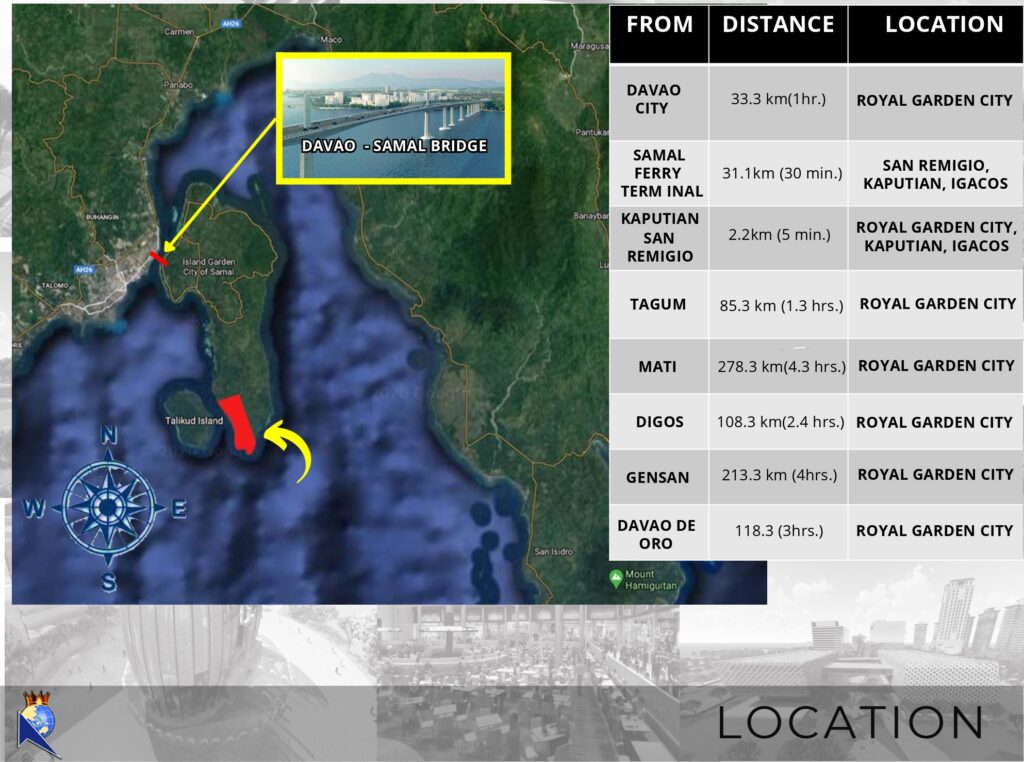

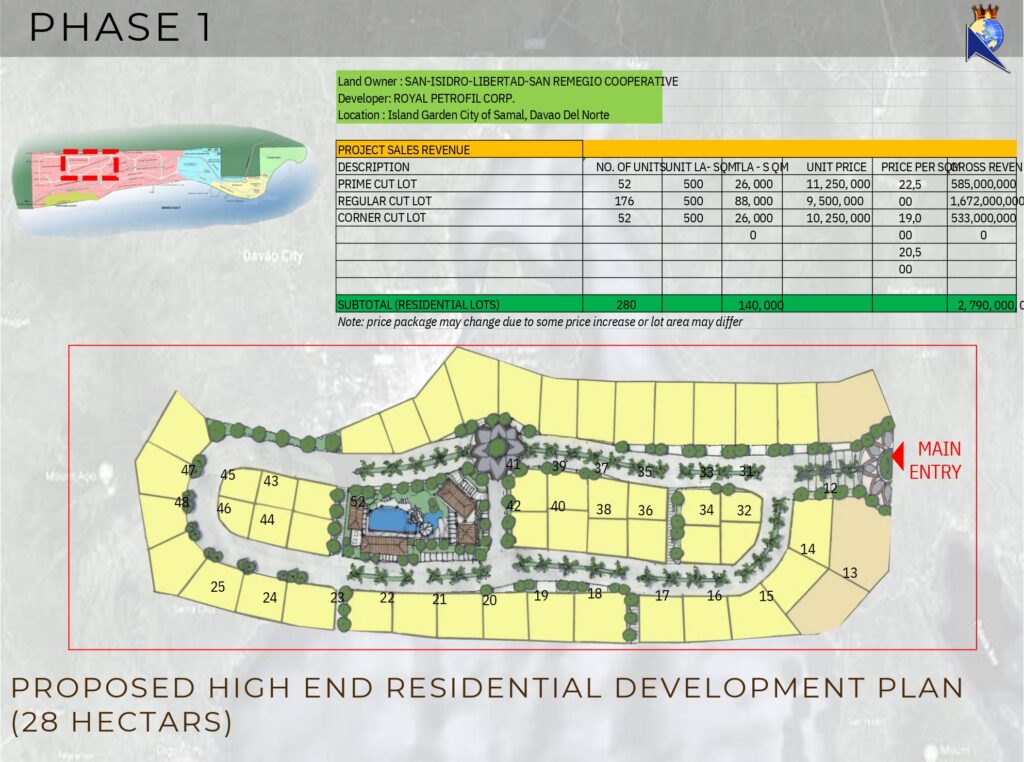

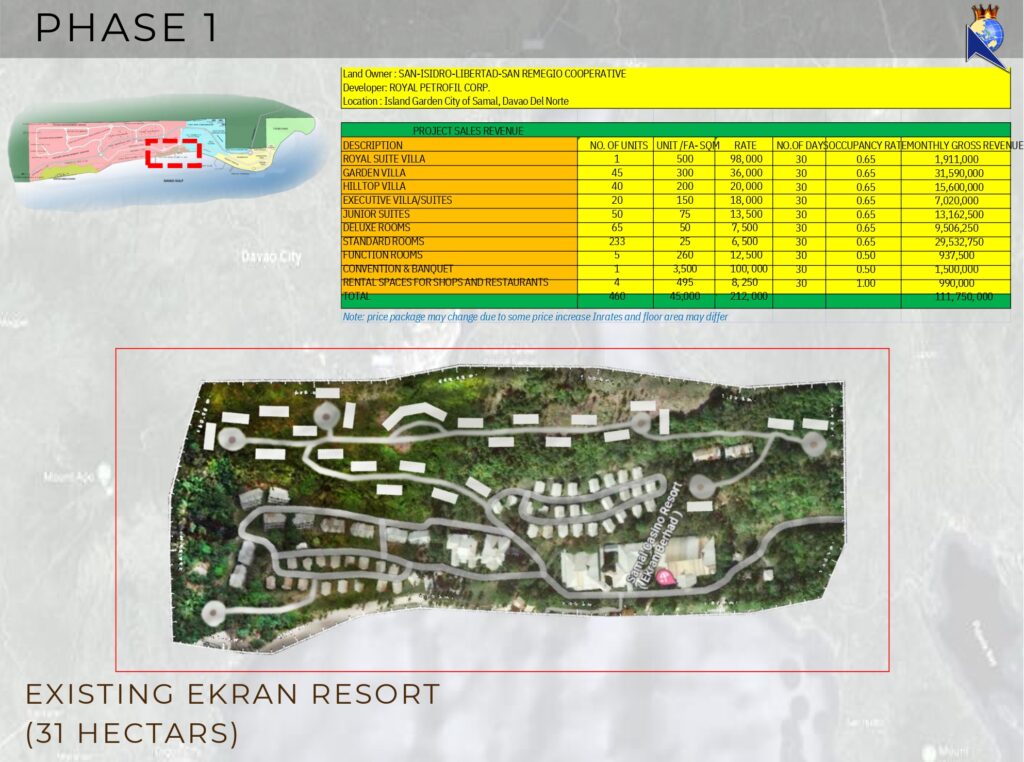

Location: Island Garden City of Samal, Davao del Norte

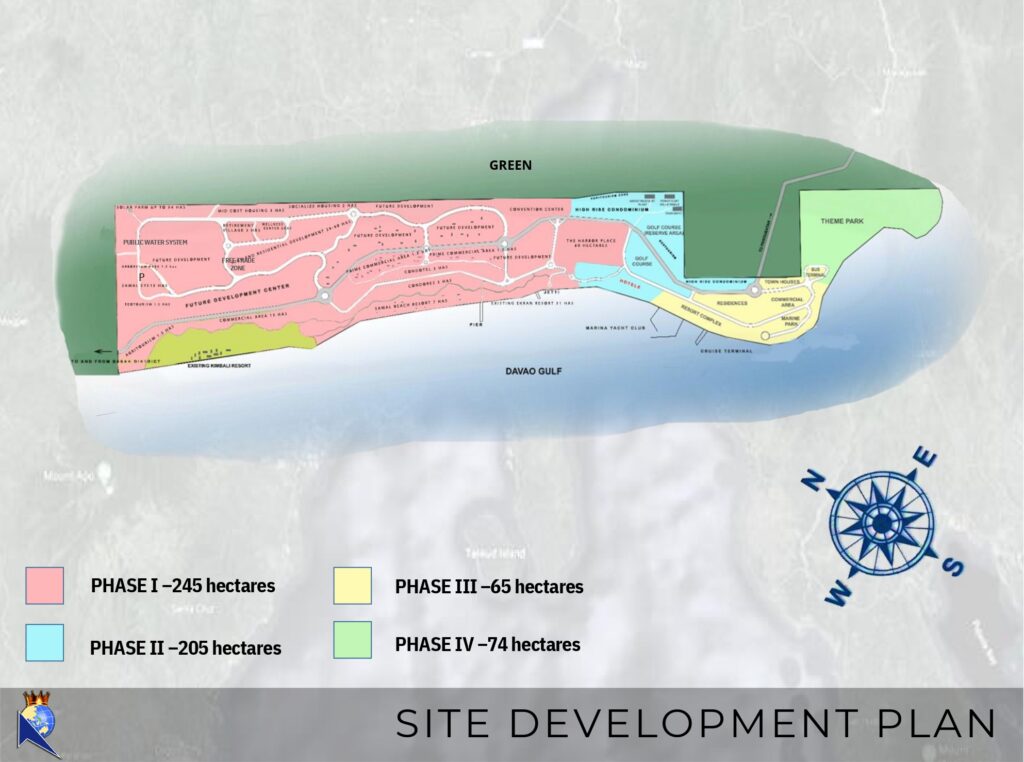

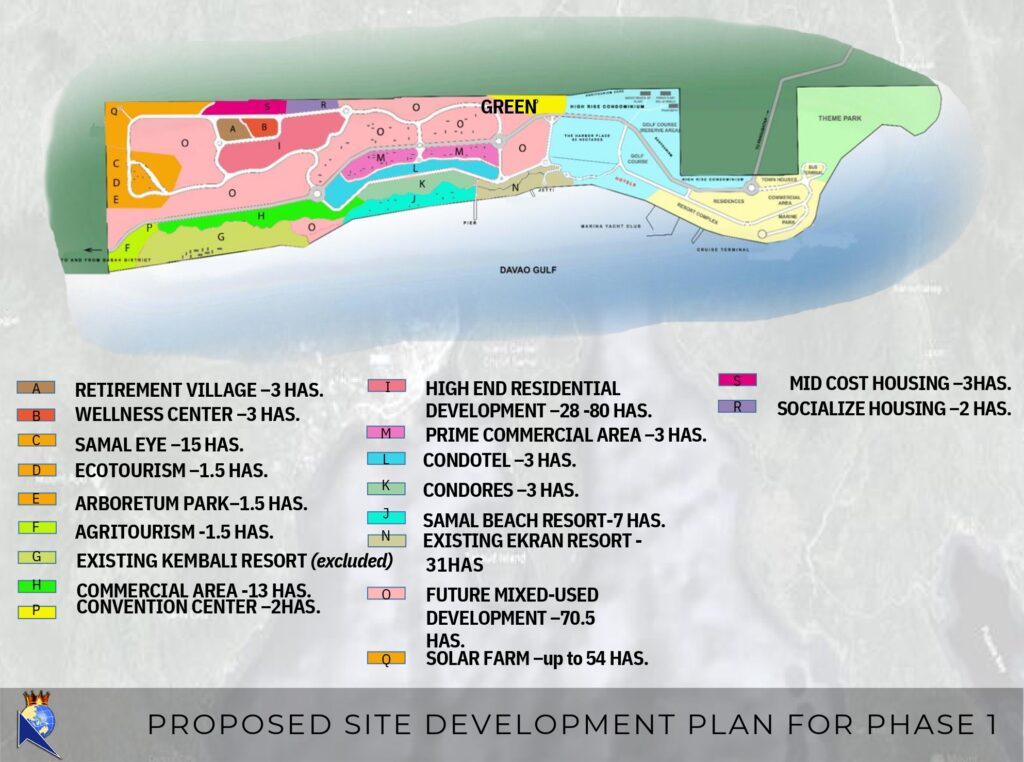

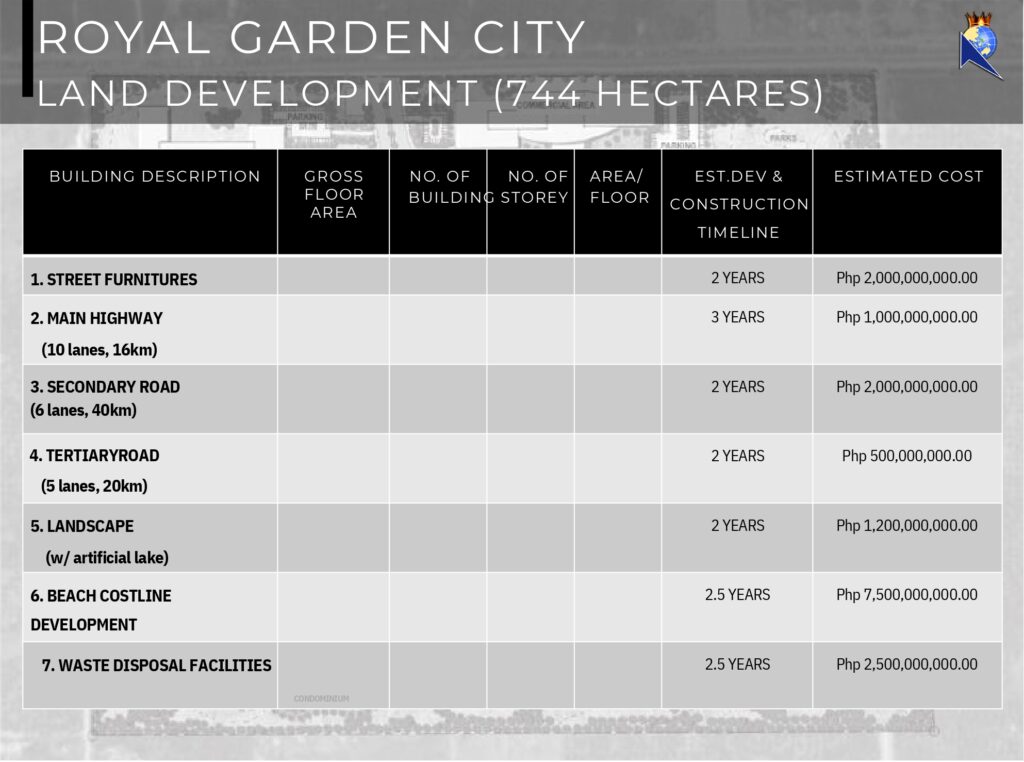

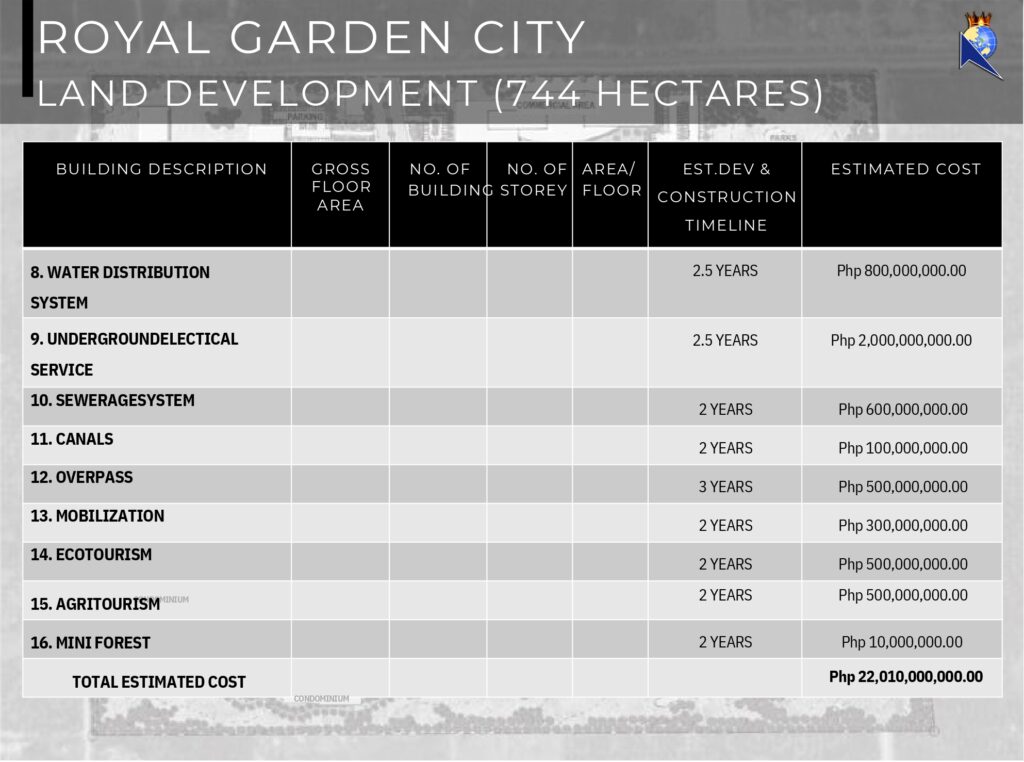

Total Land Area: 744 hectares

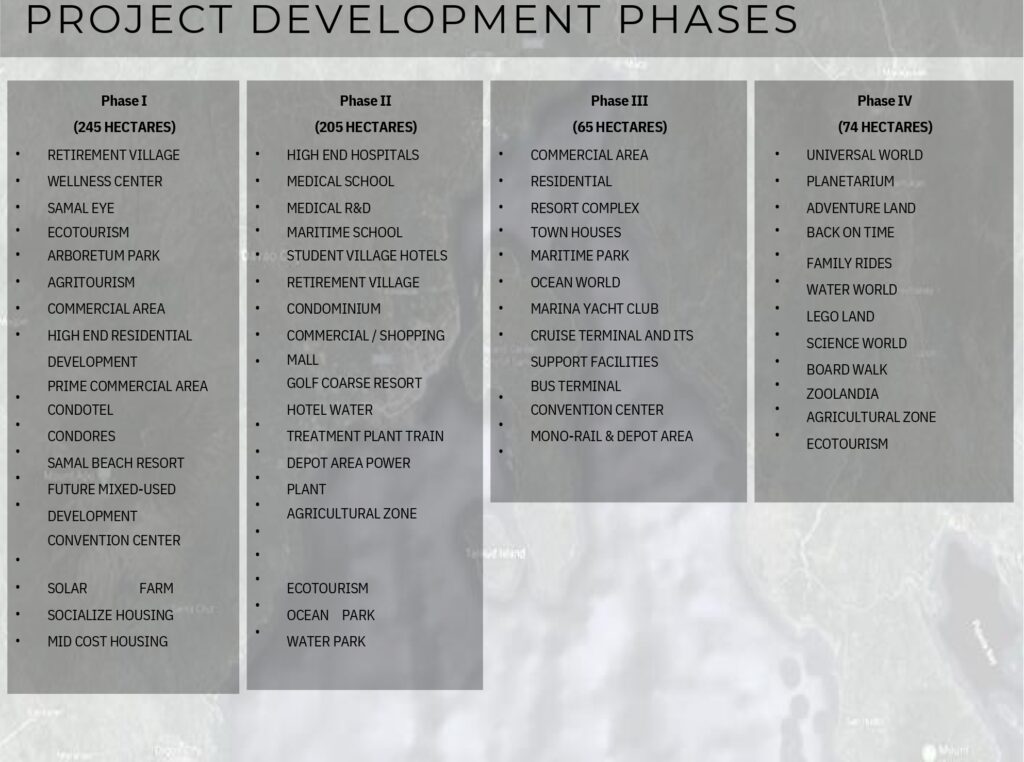

Project Components:

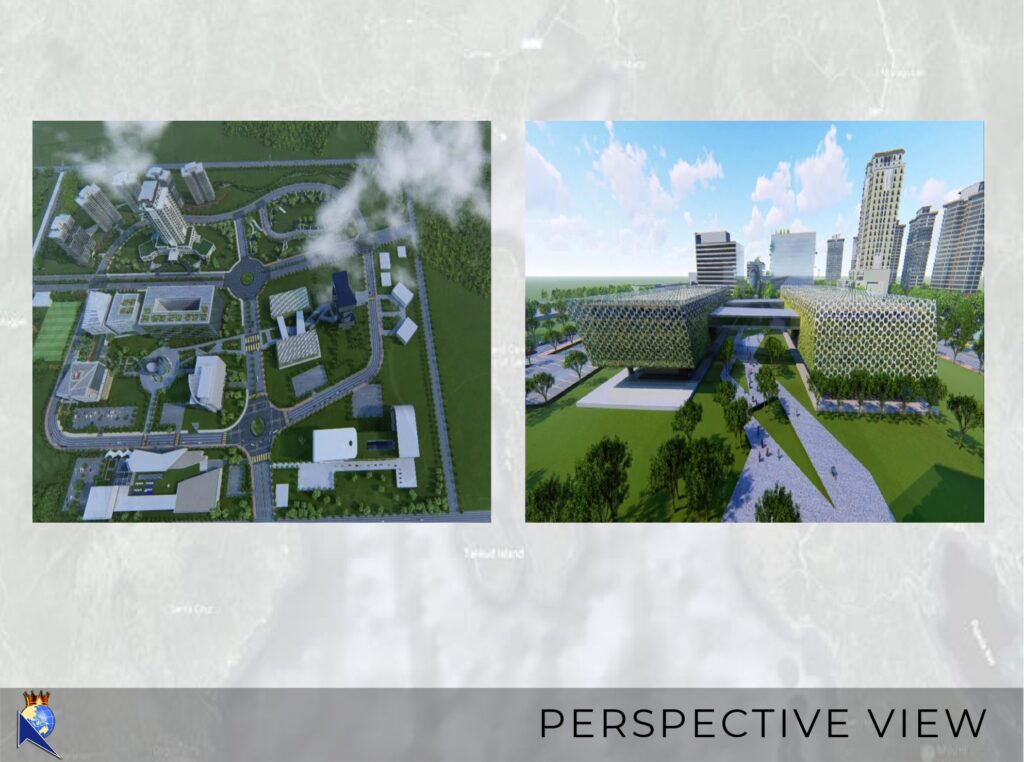

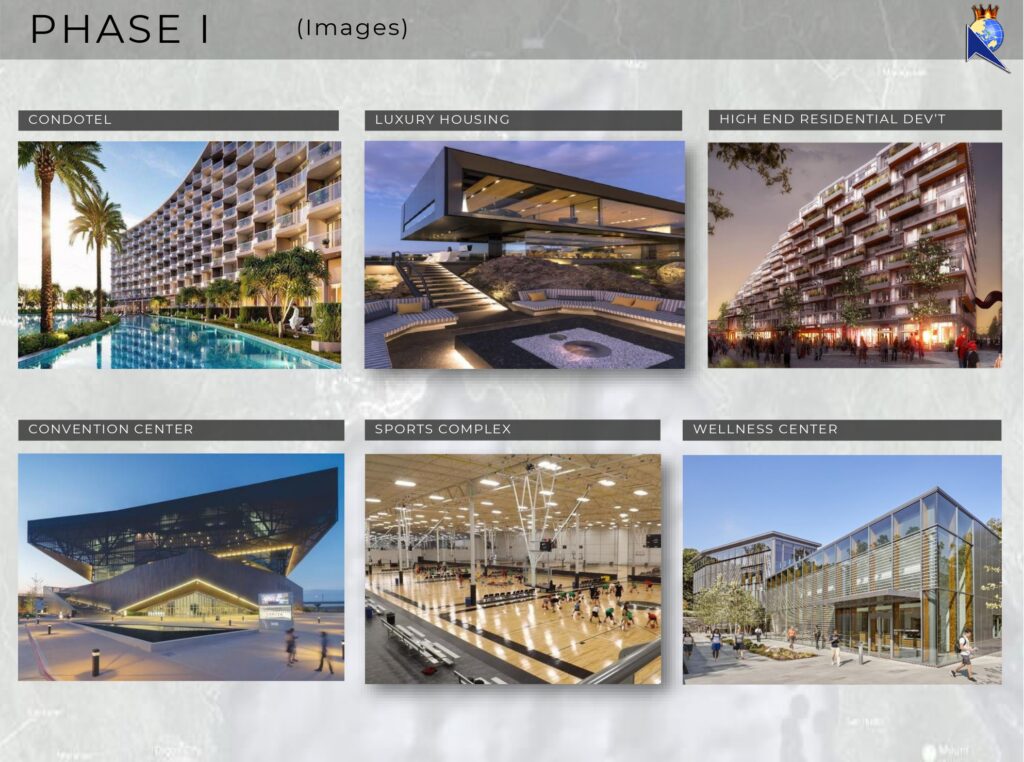

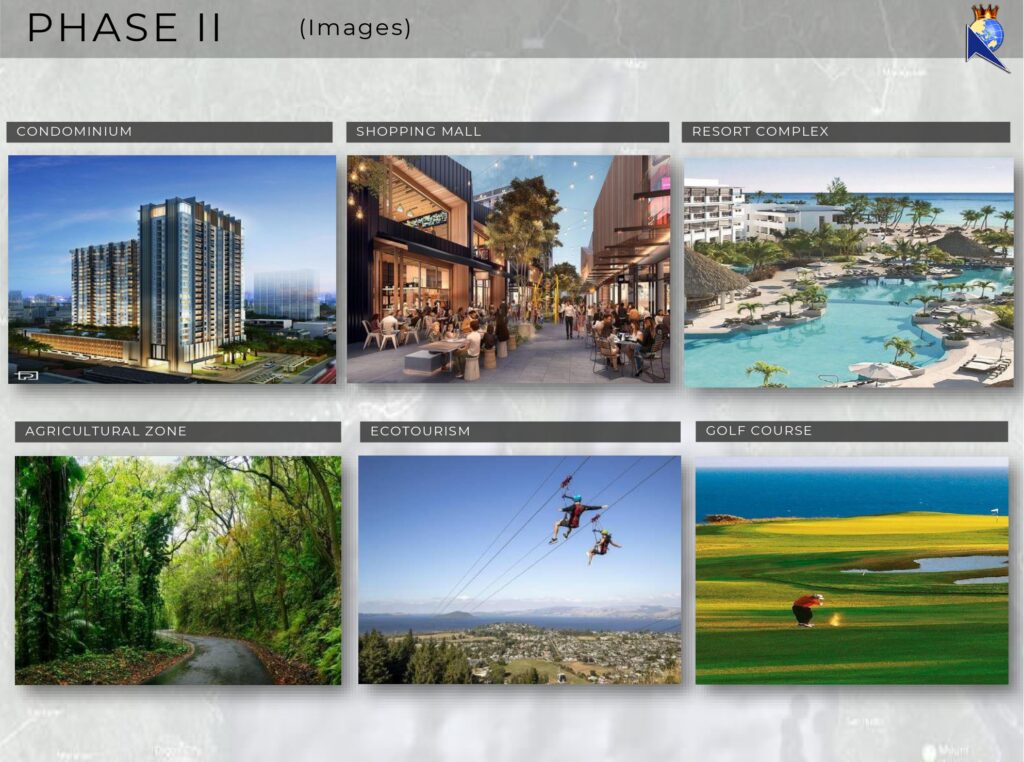

- Luxury condominium complex

- Agarwood plantation

- Supporting infrastructure and amenities

Market Analysis

Condominium Market

- Target Market: Upper-middle to high-income buyers seeking luxury living in natural settings

- Market Growth: Steady increase in demand for eco-friendly luxury accommodations

- Competition: Limited comparable developments combining agriculture and residential units

Agarwood Market

- Global demand continues to exceed supply

- Premium pricing for high-quality agarwood

- Established export markets in the Middle East and Asia

Technical Feasibility

Condominium Development

- Construction Timeline: 3-5 years

- Building Specifications: Modern luxury units with sustainable features

- Infrastructure Requirements: Access roads, utilities, waste management systems

Agarwood Plantation

- Cultivation Area: 500 hectares

- Growth Period: 7-10 years to maturity

- Required Resources: Irrigation systems, specialized farming equipment

Financial Analysis

Investment Requirements

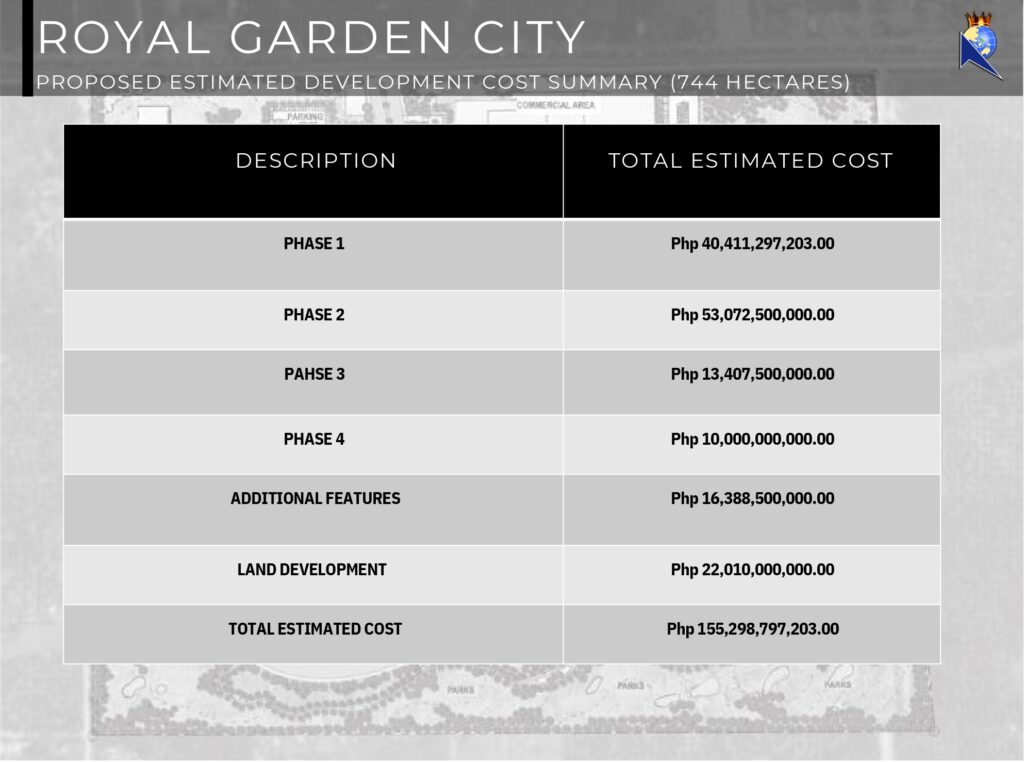

- Capital: $5.5 Billion

- Development Costs

- Land acquisition

- Construction costs

- Plantation setup

- Infrastructure development

Revenue Projections

Condominium Revenue (10-Year Projection)

- Sales Revenue: $16 billion

- Rental Income: $1.2 billion

- Total EBITDA: $17.8 billion

Agarwood Revenue (10-Year Projection)

- Estimated yield: 500,000 mature trees

- Revenue per tree: $20,000 price per kilo

- Total Projected Revenue: $10 Billion

Return on Investment (ROI) Analysis

- Condominium ROI

- Initial Investment Recovery Period: 6-9 years

- Projected ROI: 356% by year 10

- Agarwood Plantation ROI

- Initial Investment Recovery Period: 7-8 years

- Projected ROI: 200% by year 10

- Combined Project ROI

- Overall Project ROI: 556% by year 10

- Annual ROI: 55%

Management Structure

- Ownership Structure

- 60/40 profit-sharing arrangement

- Joint venture partnership

- Operational Management

- Professional property management team

- Agricultural experts for plantation

- Sales and marketing team

Environmental Impact

- Sustainability Measures

- Green building design

- Sustainable farming practices

- Water conservation systems

- Environmental Benefits

- Carbon footprint reduction

- Biodiversity preservation

- Soil conservation

Conclusion

Based on comprehensive analysis, The Hillside Haven project demonstrates strong feasibility with:

- Robust market demand for both components

- Strong financial returns

- Manageable risks

- Positive environmental impact

The two revenue sources from real estate and agriculture provide stability and significant development potential. The project’s distinct location and high expected profits make it an appealing investment prospect.